Get the shortest, most impactful weekly email on the web.

Sign up for the Weekly Letter from Certified Financial Planner™ and New York Times columnist Carl Richards.

No spam. Just a weekly email you’ll actually look forward to getting.

What Readers of the Weekly Letter Are Saying

I've subscribed and unsubscribed to thousands of newsletters—one of the only ones I look forward to seeing in my inbox is from Carl Richards. Go check him out!

Domenico D'Ottavio

One of the few things I look forward to getting each and every week.

Divine Gracia Anies

Your drawings are a continual reminder to question and think independently. Well done, and keep up the great work!

Gavin Hall

On a consistent basis, your stuff is the best written work I see in about any category I can think of.

Kevin McIntosh

I find each read very simple and to the point. The simplicity makes such an impact, and definitely leaves your audience thinking.

Emily White

I look forward to each one, and I love the way they make me take the time to think about what they mean.

Faye Kincaid

I have always enjoyed it because you took the time to think about an issue and compress it to its core. Words are powerful! Your drawings are a lovely example of getting to the root of an issue.

Robert Cleaver

I LOVE your emails!!!! Thank you for saving my day every single time I receive one. You are a blessing.

Margaret Wang

Refreshingly short and to the point without ever lacking impact.

Daphne Singer

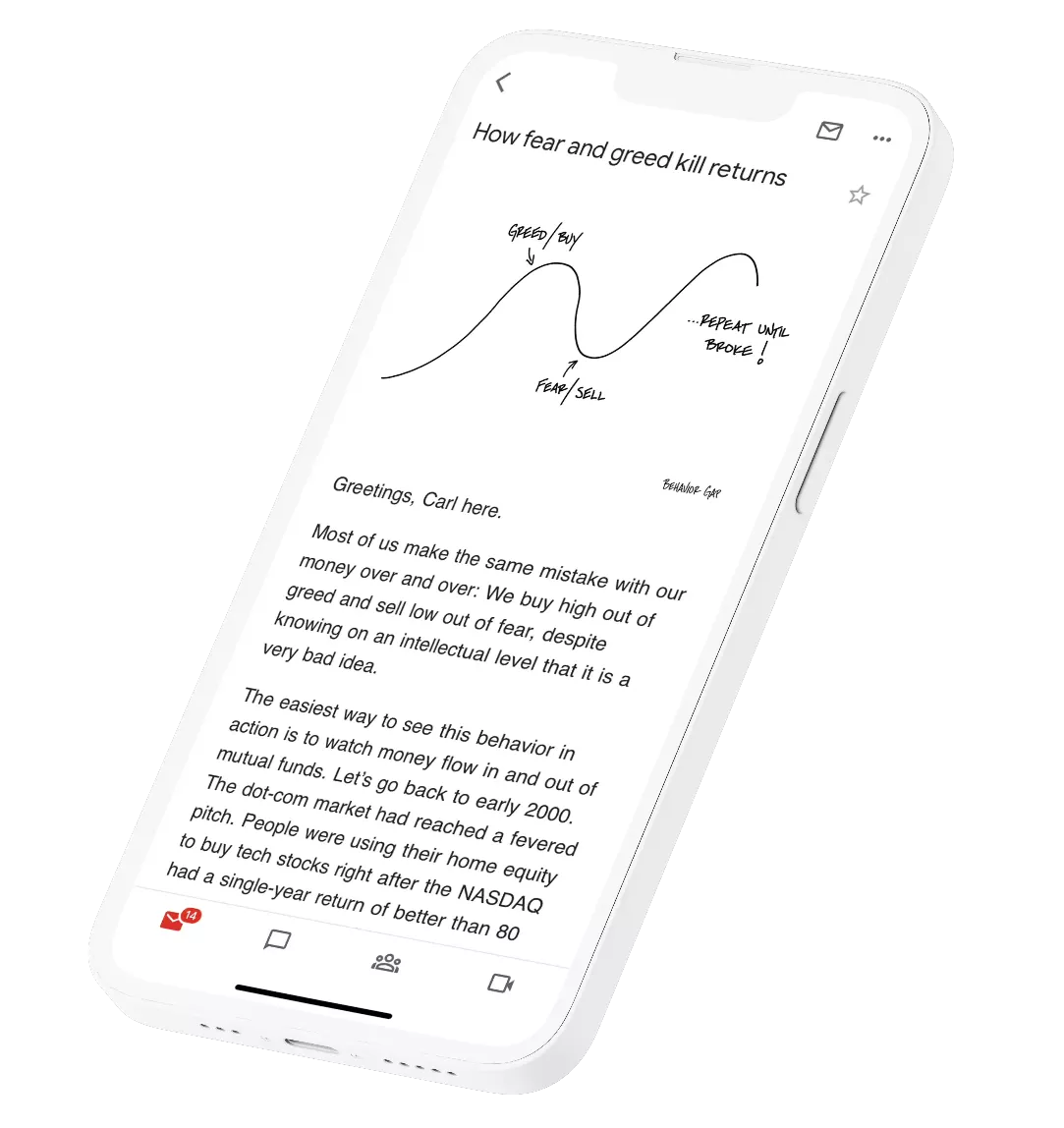

Greetings, Carl here.

I’m a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times for 10 years. Click here to learn about me and my work.

In addition to writing, sketching, and podcasting, I am a frequent keynote speaker at financial planning conferences and visual learning events around the world. Click here to submit a speaking request.

Get one of my sketches in your inbox each week.

My goal is to give you a little shot of distilled wisdom that will only take you a few minutes to read, but if I do it right, it will leave you thinking all week. I work hard to send you less.

No spam. Just a weekly email you’ll actually look forward to getting.